Tags: Probate, Wills And Probate

The Government proposes to increase Probate fees to as much as £6,000 for the largest estates in April 2019.

This move is heavily opposed by MPs, Lords in the House of Lords, STEP, Solicitors For the Elderly, the Law Society and Solicitors across England and Wales.

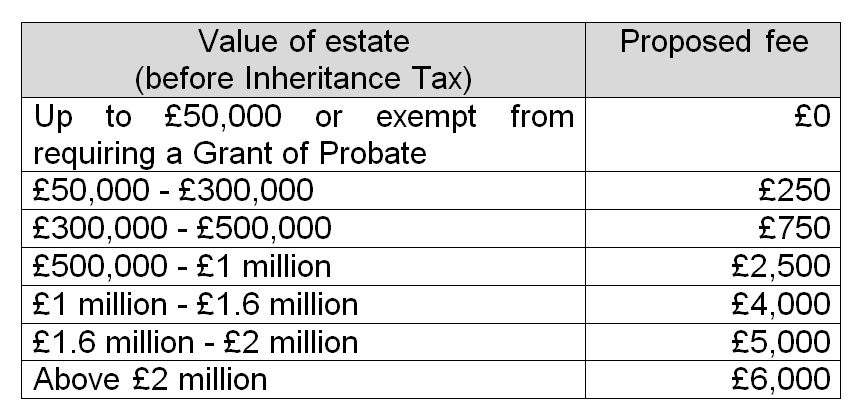

Fees structure

The Law Society has been rallying for people to write to their local MP’s, objecting to the proposal which many feel is a stealth tax on larger estates.

The reason for opposition to the fee increases is that the fee proposals are hugely disproportionate to the actual cost of the service being provided by the Probate Court.

The current flat fee for those applying through a Solicitor on any estate is £155. Under the new proposals, estates valued at more than £2 million will be facing a charge of £6,000.

The proposed increase would also hit ordinary families - where an estate includes a fairly modest house, the value of the estate can easily be over £300,000 resulting in a fee increase from £150 to £750.

Even the House of Lords tried to stop the Government introducing this change in the law when on 18 December 2018 Lord Marks said “this House declines to approve the draft order, because it would be an abuse of fee levy and power, since the proposed increased fees substantially exceed the cost involved in making Grants of Probate and would amount to a tax, which should only be introduced, if at all, by primary legislation”.

Lord Beecham said that the proposals were “so far above the actual cost of the service (it) arguably amounts to a stealth tax and, therefore, a misuse of the fee-levying power… and that this order represents a significant move away from the principal that fees for a public service should recover the cost of providing it and no more”.

The Law Society issued a briefing note stating “the service involved in a Grant of Probate is the same whether an estate is worth £50,000 or £2 million. However, under the new proposals, some estates would face a charge of £6,000. This is excessive …. it is unfair to expect the bereaved to fund/subsidise other parts of the Courts and Tribunals Service, particularly in circumstances where they have no other options but to use the Probate Service”.

The Society for Trusts and Estates Practitioners (STEP) states “STEP is particularly concerned about the fairness and practicality of the new regime, as well as the legality of the Government’s plans to try to introduce this measure without any proper debate via Statutory Instrument”.

Solicitors for the Elderly, who are experts in issues around Wills and Probate, issued a press statement. Their spokesperson said “SFE is extremely disappointed to see that the consensus to reject the proposed Probate fees has been ignored. For the 62% of estates that use a Solicitor, Probate Registry performs a purely administrative role, and the value of the estate has no bearing on the work undertaken”.

This is money which bereaved families will need to find to pay the Courts and Tribunals Service in order to obtain the Grant of Probate or Grant of Letters of Administration before they can access their loved one’s assets.

The Government wishes to bring this law into effect on 1 April 2019. MP’s at the House of Commons now have only one more chance to raise formal objections.

The Labour Party has indicated they will force a vote in the House of Commons to try and stop the proposals going through.

If you object to this increase, write to your local MP now, asking them to oppose the bill. You can find details of your MP, and how to contact them, here

If you are currently an Executor for someone who has died, we recommend that you take immediate advice from your Solicitor regarding any implications for your case.

Darrell Collins TEP is a Solicitor and Partner at FDC Law Solicitors. She heads the Private Client Department at FDC Law. She is a member of STEP, SFE and an expert in managing complex estates.

No current news stories.