In accordance with SRA requirements, we aim to provide guidance about likely costs for certain types of work.

Please note that the information here is a guide to show the normal range of costs for different kinds of work. VAT is added at the rate applicable for the time at which the bill is raised, (Currently 20%)

Except where a fixed fee is agreed, the actual costs in your case may be lower, or higher, than those set out below, depending on your specific needs and the details of the work you ask us to carry out. In all cases, when you instruct us to carry out work for you, we will provide you with a tailored, written, costs estimate as part of our client care letter, which will set out details of the likely costs, and the person who will be carrying out the work, based on the specific instructions you give and the work you want us to do for you.

Details of the individual dealing with your case, and the name of their supervisor will be confirmed when you first instruct us, however, you can see details of all of our lawyers in the 'Our People' section of our website. In each case, the superviser is the head of the relevant department.

CONVEYANCING (Buying or Selling your home or other property)

Our fees cover all of the work required to complete the sale of your current home or the purchase of your new home, including dealing with registration at the Land Registry and dealing with the payment of Stamp Duty Land Tax (Stamp Duty) if the property you intend to buy is in England, or Land Transaction Tax (Land Tax) if the property you wish to buy is in Wales.

Legal Fees

These are set on sliding scale subject to the value of the property:

Property Value Usual Fee

£0.00 - £100,000.00 £ 995.00 + VAT (£1,194 Total)

£150,000.00 - £250,000.00 £1,095.00 + VAT (£1,314 Total)

£250,000.00 - £300,000.00 £1,145.00 + VAT (£1,374 Total)

£300,000.00 - £350,000.00 £1,195.00 + VAT (£1,434 Total)

£350,000.00 - £400,000.00 £1,295.00 + VAT (£1,554 Total)

£400,000.00 - £550,000.00 £1,395.00 + VAT (£1,674 Total)

£550,000.00 - £650,000.00 £1,495.00 + VAT (£1,794 Total)

£600,000.00 - £750,000.00 £1,595.00 + VAT (£1,914 Total)

£750,000.00 - £850,000.00 £1,745.00 + VAT (£2,094 Total)

£850,000.00 - £950,000.00 £1,945.00 + VAT (£2,334 Total)

If you are buying a Leasehold property, there will usually be an additional charge. This will normally be £250 + VAT (£300.00 Total) to cover the extra work involved in reviewing the freehold title, the management company information pack and the subsequent notification of the Freeholder of your ownership.

If you are buying a new-build property, there will be an extra charge of £250 + VAT (£300.00 Total) to cover the additional work involved in reviewing the planning documentation associated with the development.

Please note the extra charges may be higher or lower, depending on the specific circumstances. For example, if you are buying a leasehold house, there will not normally be any management company documentation to review, so the extra charge will be lower.

Disbursements and Additional Charges

Disbursements are costs related to your matter that are payable to third parties, such as Land Registry fees. We handle the payment of the disbursements on your behalf to ensure a smoother process.

On Your Sale

As part of your sale the disbursements will include:

Title Information Documentation £ 3 per document

Completion Fee £35 + VAT. (£42.00 Total)

On a Leasehold sale, you may be required to obtain a Leasehold Information Pack from the Landlord or Management Company. You should check with your freeholder/management company as to the cost of their providing this information.

On Your Purchase

As part of the investigations and completion of your purchase the disbursements will include:

Searches around £335.00. The exact amount is dependent on the area in which you are buying

Bankruptcy Fee £ 2.00 per person

Priority Search £3.00

Completion Fee £35.00 + VAT (£42.00 Total)

SDLT Submission Fee £30.00 + VAT (£36.00 Total)

On a Leasehold purchase you may also incur disbursements payable to the Landlord or their representatives. These disbursements can vary significantly as they depend on what the Landlord charges. You may wish to ask the agent to check this information before you make an offer. Examples of these disbursements include:

Notice of Transfer fee – This fee if chargeable is set out in the lease. Often the fee is between £50 - £250.

Notice of Charge fee (if the property is to be mortgaged) – This fee is set out in the lease. Often the fee is between £50 - £150.

Deed of Covenant fee – This fee is provided by the management company for the property and can be difficult to estimate. Often it is between £50 - £250.

Certificate of Compliance fee - To be confirmed upon receipt of the lease, as can range between £10 - £150.

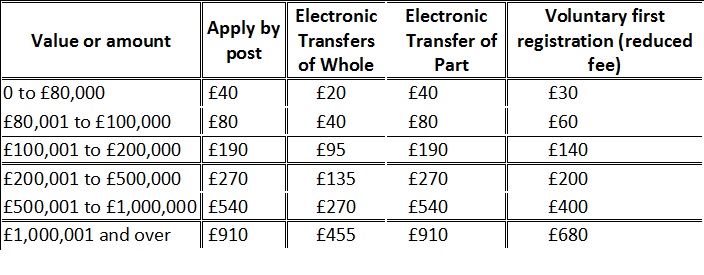

Land Registry fees are incurred on a value basis as shown:

Scale 1 fees

Stamp Duty or Land Tax (on purchase only)

This depends on the purchase price of your property. You can calculate the amount you will need to pay by using HMRC's website or if the property is located in Wales by using the Welsh Revenue Authority's website http://gov.wales/welsh-revenue-authority

Complex Transactions

Sometimes sales or purchases are complex and the work cannot be done on a fixed fee basis. If you feel your sale or purchase is more complex, please contact one of our offices to discuss the type of sale or purchase involved and we can provide a clearer indication as to the costs involved.

How long will my house purchase take?

How long it will take from your offer being accepted until you can move in to your house will depend on a number of factors. The average process takes between 12 - 16 weeks from acceptance of an offer to completion and final registration of a purchased property with the Land Registry.

It can be quicker or slower, depending on the parties in the chain. For example, if you are a first time buyer, purchasing a new build property with a mortgage in principle, it could take 8 - 10 weeks. However, if you are buying a leasehold property that requires an extension of the lease, this can take significantly longer, between 4 and 6 months. In such a situation additional charges would apply.

Stages of the process

The precise stages involved in a sale or purchase of a residential property vary according to the circumstances. As part of the process we will:

Take your instructions and give you initial advice

Check finances are in place to fund purchase or obtain a redemption figure from your lender to ensure there is no negative equity

Check title documentation to ensure the correct party is the seller

Submit or receive contract documents

Carry out searches and submit enquiries to the seller’s solicitor or answer queries submitted by the purchaser’s solicitor

Give you advice on all documents and information received

If applicable, go through conditions of mortgage offer with you or provide a redemption statement to confirm the sum to be paid

Send final contract to you for signature

Agree completion date (date from which you own or leave the property)

Exchange contracts and notify you that this has happened

Arrange for all money needed to be received from your lender, or obtain a final redemption statement from your mortgage company

Complete purchase or sale

On your purchase deal with payment of Stamp Duty/Land Tax and submit an application for registration at Land Registry

On your sale discharge any legal charge and provide you with payment of the remaining balance

Equity Release

We also provide a service providing the legal advice required by lifetime mortgage lenders and the submission of the subsequent documentation to enable the funds to be drawn down.

Legal Costs £650.00 + VAT (£780.00 Total)

Completion Fee £35.00 + VAT (£42.00 Total)

Charge for Money Laundering / ID Checks £17.50 + VAT per person on the title (£21 Total)

On your instruction we will:

check the title to the property to ensure the correct parties are named on the deeds and on the lifetime mortgage documentation

complete the documentation required as part of the application

check for buildings insurance cover

check the resulting title documentation post-completion.

Transfers of Equity

This action alters the ownership of a property or land according to your wishes. If you are transferring the ownership of a property where there is still a mortgage, you will need to get your mortgage lender’s permission to make the change in ownership, as it will affect their security over the property and ability to be repaid.

If there is no mortgage, the costs will be

Legal Costs on a registered title £550 + VAT (£660.00 Total)

Legal Costs on an unregistered title £695 + VAT (£834.00 Total)

Where a lender is involved, we will make an additional charge of £150 + VAT (£180.00 Total) to cover the extra work needed in liaising with them before and after completion.

As part of the process we will also incur disbursements, these will typically include:

Title information

documentation £3.00 per document

Completion Fee £35 + VAT (£42.00 Total)

SDLT Submission Fee £30 + VAT (£36.00 Total)

Charge for Money Laundering Check £17.50 + VAT per person (£21Total)

Land Registry Fee £Variable

The Registration Fee to the Land Registry is dependent on the value of the share of the property being transfer. The fees are set out in the table above.

As part of this kind of job we will:

Check the title to the property and its ownership

Draft the appropriate Transfer Deed and ensure suitable provisions are included to protect the parties involved

Liaise with any lender if they need to be included in the transfer

If required, submit the SDLT application

Submit the Transfer Deed for registration purposes or if the property is unregistered, we will collate all the deeds to submit them to the Land Registry for First Registration.

Applying for the Grant, Collecting and Distributing the Assets

We anticipate this will take between 10 and 20 hours work at £200.75* (£240.90 inc VAT) per hour (depending on which fee earner is doing the work, as the hourly rate differs). Total costs estimated at £2,000 (£2,400 inc VAT) to £4,000 (£4,800 inc VAT).

The exact cost will depend on the individual circumstances of the matter. For example, if there is one beneficiary and no property, costs will be at the lower end of the range. If there are multiple beneficiaries, a property and multiple bank accounts, costs will be at the higher end.

We will handle the full process for you. This estimate is for an estate where:

Anticipated disbursements (not included in this fee):

(Disbursements are costs related to your matter that are payable to third parties, such as Court fees. We handle the payment of the disbursements on your behalf to ensure a smoother process)

Potential Additional Costs

How Long Will This Take?

On average, estates that fall within this range are dealt with within 6-12 months, depending on number of assets. Typically, obtaining the Grant of Probate takes 4-6 weeks. #Collecting assets then follows, which can take between 4-6 weeks. Once this has been done, we can distribute the assets, which normally takes 4-6 weeks.

*This is an average hourly rate: The specific rate will depend on the person carrying out the work. Hourly Rates are currently: Partners:£265 (£318 inc VAT), Senior Solicitors: £265 (£318 inc VAT) Solicitors:£245 (£294 inc VAT), FCILEx £245 (£294 inc VAT), CILEX and other legal executives £225 (£270 inc VAT) and Trainees £150 (£180 inc VAT).

In some cases it is not advisable to distribute until at least six months after the grant of probate. If this is applicable to your case, we will let you know.

Probate – Grant only (Fixed Fee)

We can help you through this difficult process by obtaining the Grant of Probate on your behalf.

How Much Does This Service Cost?

TOTAL: Fixed fee of £900.00 + VAT (£1080.00 total).

This includes: obtaining the Grant only.

Breakdown of costs:

Disbursements are not included in the fixed fee. Disbursements for obtaining a grant of probate are:

As part of our fixed fee we will:

On average, estates that fall within this range are dealt with within 2 to 4 months (from receipt of all the relevant information from you). The Probate office currently advises that they usually issue grants of probate within 16 weeks of receiving all the documentation.

These costs apply where your claim is in relation to an unpaid invoice which is not disputed and enforcement action is not needed. If the other party disputes your claim at any point, we will discuss any further work required and provide you with revised advice about costs if necessary, which could be on a fixed fee (e.g. if a one off letter is required), or an hourly rate if more extensive work is needed.

|

Debt value |

Court fee |

Our fee |

|

Up to £5,000 |

£35-£205 |

5% value of the claim plus VAT, subject to a minimum of £195 plus VAT |

|

£5,001 - £10,000 |

£455 |

5% value of the claim plus VAT |

|

£10,001 - £50,000 |

5% value of the claim |

5% value of the claim plus VAT |

Anyone wishing to proceed with a claim should note that:

Our fee includes:

Matters usually take 4-12 weeks from receipt of instructions from you to receipt of payment from the other side, depending on whether or not it is necessary to issue a claim. This is on the basis that the other side pays promptly on receipt of Judgement in default. If enforcement action is needed, the matter will take longer to resolve.

We want to give you the best possible service. However, if at any point you become unhappy or concerned about the service we have provided then you should inform us immediately, so that we can do our best to resolve the problem.

In the first instance, you should usually contact the person who is working on your case to discuss your concerns and we will do our best to resolve any issues at this stage If you have not been able to resolve the issue with the person dealing with your matter, then you can make a formal complaint. We sent you details of the process in the client care letter and terms of business sent to you when your file was opened, and you can also read our full complaints procedure here Making a complaint will not affect how we handle your case.

What do to if we cannot resolve your complaint

The Legal Ombudsman can help you if we are unable to resolve your complaint ourselves. They will look at your complaint independently and it will not affect how we handle your case.

Before accepting a complaint for investigation, the Legal Ombudsman will check that you have tried to resolve your complaint with us first.

If you have, then you must take your complaint to the Legal Ombudsman:

Within six months of receiving a final response to your complaint

and

No more than six years from the date of act/omission; or

No more than three years from when you should reasonably have known there was cause for complaint.

If you would like more information about the Legal Ombudsman, please contact them.

Contact details

Visit: www.legalombudsman.org.uk

Call: 0300 555 0333 between 9am to 5pm.

Email: enquiries@legalombudsman.org.uk

Legal Ombudsman PO Box 6806, Wolverhampton, WV1 9WJ

The Solicitors Regulation Authority can help you if you are concerned about our behaviour. This could be if you felt that there were any concerns about anything such as dishonesty, taking or losing your money or treating you unfairly because of your age, gender, a disability or other personal characteristic.

You can raise your concerns with the Solicitors Regulation Authority.